Preparing Healthcare CFOs for Business During a Biden Presidency

While Biden’s legacy under the Obama administration was tied to the Affordable Care Act, so will his presidency. COVID-19, value-based care, and price transparency will also mark the next four years.

- For many voters, the 2020 presidential election was less about red and blue and more about white, as in the white coat.

Healthcare was a dominant issue in the race between the incumbent President Donald J. Trump and Democratic runner Vice President Joe Biden. Not only did the election take place just before the Supreme Court took up the debate over the legality of the Affordable Care Act’s individual mandate, but more importantly, during a once in a lifetime public health crisis.

This perfect storm had a majority of Americans voting with health policy in mind this fall.

It was ultimately the candidate who had a hand in crafting the Affordable Care Act (ACA) who garnered over 270 electoral votes – and over 50 percent of votes nationwide – to win the presidency. And that landmark healthcare legislation, which has defined President-elect Biden’s healthcare legacy under the Obama administration, will also likely dominate his administration’s approach to healthcare reform and policy.

But whether the now more conservative Supreme Court strikes down the entire ACA or just parts of it, Biden is also preparing other ways to enact healthcare reform that increases competition, reduces costs, and makes the system less complex to navigate. Industry consolidation, surprise billing, and prescription drug pricing, in addition to ACA perseveration and COVID-19 response, are among the areas Biden intends to address in order to achieve these goals during the next four years as president.

However, a potentially split Congress could make it difficult for the Biden administration to execute strategies for all of those healthcare priorities and more.

So, what should healthcare CFOs and other leaders expect from a Biden presidency?

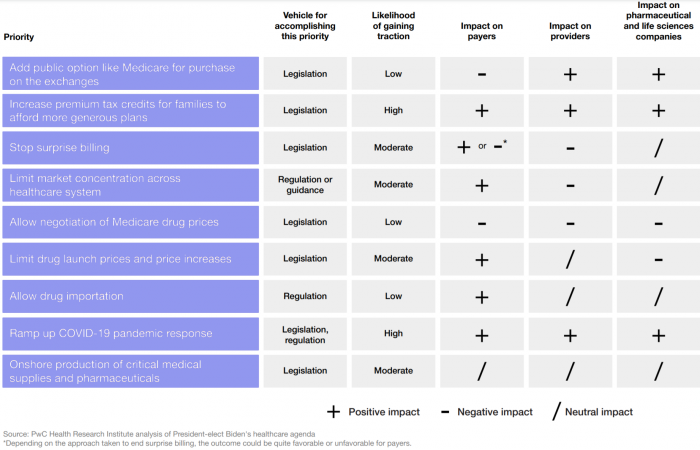

“Broadly, healthcare executives can expect an administration with an expansionary agenda, looking to patch gaps in coverage for Americans, scrutinize proposed healthcare mergers and acquisitions more aggressively and use more of the government’s power to address the pandemic,” says the Health Research Institute at PricewaterhouseCoopers (PwC).

Source: PwC, Health Research Institute

In the following article, RevCycleIntelligence breaks down Biden’s healthcare agenda, including the President-elect’s plans for COVID-19, the ACA, and industry consolidation, as well as other strategies the administration has said it will take to lower healthcare costs.

A new COVID-19 response effort

Healthcare was a top issue in the 2020 election largely because of COVID-19.

The COVID-19 pandemic has been a once-in-a-lifetime event that has had a disproportionate impact on providers. Since the start of the year, providers have struggled to balance everyday operations and a sudden surge of patients sick with a previously unknown and highly contagious virus.

The healthcare industry has been critical of the Trump administration’s response to the pandemic, with major industry groups recently pushing back against claims that physicians and hospitals are inflating COVID-19 numbers to turn a profit.

Biden has promised to take a different approach to the COVID-19 response, and one based on science and transparency, the President-elect says on a new website on Biden’s transition to office.

According to Biden’s transition team, there is a seven-point plan to combat COVID-19. The plan includes:

- Access to regular, reliable, and free COVID-19 testing

- Increases in the supply of personal protective equipment

- Evidence-based guidance on how communities could navigate the pandemic

- Equitable distribution of treatments and vaccines

- Increased protections for older and high-risk Americans

- New defenses for predicting, preventing, and mitigating pandemic threats

- Mask mandates nationwide

Key ways the team plans to implement the seven points include a renewable fund for state and local governments; $25 billion for vaccine manufacturing and distribution; 100 percent reimbursement for COBRA coverage for Americans who lost employer-sponsored coverage during the pandemic; more drive-through testing sites; and the invocation of the Defense Production Act to increase PPE supply. Biden has also promised to establish a COVID-19 Racial and Ethnic Disparities Task Force.

The Health Research Institute says Biden’s COVID-19 response plan is a plus for providers who have had to overcome myriad challenges, including PPE shortages, worsening racial and ethnic health disparities, and strategies for opening their doors for elective services after widespread shutdowns.

But again, a split Congress could make it difficult for Biden to execute major COVID-19 legislation, including another massive stimulus package that includes additional funding for CARES Act initiatives, like the Provider Relief Fund.

“The financial conditions for many healthcare providers, in particular, hang on how quickly the pandemic ebbs and whether patients who have long deferred care wind up arriving in hospitals requiring much more expensive and intensive treatment than they would have otherwise,” the Health Research Institute states. “Patients who lose their coverage because of the pandemic’s economic calamity also may seek care without the means to pay for it, leading to increases in uncompensated care and bad debt.”

Many healthcare providers are already seeing increases in uncompensated care and bad debt as a result of COVID-19 and its impact on private healthcare coverage. In fact, nearly half of hospitals have experienced a rise in compensated care and bad debt since the start of the pandemic, and over 40 percent have also seen the percentage of uninsured or self-pay patients increase.

Meanwhile, about 38 percent of hospital executives have reported that the percentage of privately insured patients – who typically bring in higher revenue compared to publicly insured patients – is down.

“The financial conditions for many healthcare providers, in particular, hang on how quickly the pandemic ebbs."

So, what’s next for the ACA and healthcare coverage?

When President Barack Obama signed the ACA into law on March 23, 2010, Biden was by the president’s side. But since that day, Republicans and, most recently, the Trump administration have sought to dismantle the landmark healthcare law, arguing that it is an overreach of federal power.

The ACA’s fate is again in the hands of the Supreme Court, which is currently taking up the law’s individual mandate provision. However, Biden has vowed to protect the legislation he saw signed into law a decade ago and he plans to expand it.

According to the Biden campaign’s website, the President-elect intends to insure more than 97 percent of Americans by increasing the value of tax credits offered for plans sold on ACA’s individual market (eliminating the 400 percent income cap on eligibility and lowering the limit on coverage costs from 9.86 to 8.50 percent) and creating a new public option that would resemble Medicare.

Biden’s tax credit proposal alone would save nearly all current Marketplace enrollees hundreds of dollars a month, as well as draw more people to the marketplaces, according to a recent analysis by Kaiser Family Foundation. Physicians also generally prefer a public option for coverage and/or improvements to the ACA compared to more left-leaning proposals like Medicare for All, and they overwhelmingly agree that increased access to affordable coverage is a top priority for the future of healthcare, The Physician’s Foundation reports.

But a Republican-controlled Senate could hinder efforts to pass changes to the ACA, if the Supreme Court deems the law constitutional.

There are still ways Biden could execute ACA reforms.

Similar to President Trump’s strategy for “sabotaging” the ACA, Biden could leverage executive power to reverse the previous administration’s cuts, including the implementation of short-term limited duration plans. The President-elect could also announce a special enrollment period for the uninsured population and boost marketing and advertising of marketplaces.

Lowering the Medicare eligibility age and offering plans in states that did not expand Medicaid are also key ways Biden could increase access to affordable coverage, the Health Research Institute explains.

Overall, the Institute projects Biden’s ACA plans to have a positive impact on providers. The reforms could very well stymy the growth of the uninsured rate, which is expected to increase by 2.9 million people by the end of the year because of COVID-19, as well as recent increases in hospital uncompensated care and bad debt.

The trade-off, however, would be provider reimbursement rates more in line with Medicare than higher private payer rates if a public option is somehow implemented during the Biden presidency.

“If there are more people in the public option plan, they can negotiate prices with hospitals, which is not great for providers,” says Caroline Znaniec, a managing director in CohnReznick Advisory’s healthcare practice. “We expect payers will take a more proactive approach to better manage care rather than lose the employer-sponsored market, which provides the largest share of coverage in the US.”

Bringing down healthcare costs

“Both the Trump Administration and Biden campaign have made healthcare costs a signature issue, but took different approaches."

As much as Biden tried to separate his healthcare reform policies from President Trump’s, there is some overlap when it comes to the problem of healthcare costs.

Healthcare’s share of gross domestic product is on track to reach almost 20 percent in less than a decade, and the COVID-19 pandemic has likely accelerated its trajectory. Therefore, bending healthcare’s proverbial cost curve has and remains a top priority for government leaders.

How to reduce costs, however, is where the Trump and Biden administrations will split.

“Both the Trump Administration and Biden campaign have made healthcare costs a signature issue, but took different approaches,” explains Rita Numerof, president of the global healthcare consulting firm Numerof & Associates.

“The Trump administration chiefly sought to tackle surprise medical billing, rising drug costs, and out-of-pocket costs for seniors through a flurry of executive orders. Biden has said he plans to both lower the age for Medicare eligibility from 65 to 60, expand coverage under Medicaid, expand upon what’s already contained in the Affordable Care Act,” Numerof states.

But as discussed above, Biden’s plan for lowering healthcare costs very much depends on the outcome of the ACA’s Supreme Court case and the makeup of Congress by January 20. In the meantime, the President-elect will need to lean on other methods for cutting costs, including some that were undertaken by the Trump administration (e.g., eliminating surprising billing, increasing healthcare price transparency) and some that have been staples in the current healthcare environment, including scrutiny of mergers and acquisitions and value-based care.

But how the administration approaches those may have different nuances than previous administrations.

Healthcare price transparency & surprise billing

Government leaders have seen healthcare price transparency as a lever for reducing healthcare costs for over a decade now – remember, it was the ACA that first required hospitals to release a standard list of their prices. The Trump administration, however, has made price transparency more of a priority compared to previous administrations. And it is because of a Trump era rule that hospitals will be required to post more than their standard charges online by the time Biden takes office.

Biden will inherit this rule and some others, including a new mandate for health plans to share more consumer-specific pricing information, and it is unlikely his administration will ease up on providers even though they have staunchly opposed price transparency requirements.

“Enforcing healthcare transparency will be a top priority for the next administration,” says Numerof. “CMS’ price transparency final rule is set to go into effect at the start of the new year, after which point providers that don’t comply with its mandate to offer ‘shoppable services’ to patients in a tangible, understandable format will be penalized. It will be on the Biden administration’s CMS to hold providers accountable and ensure that patients are given everything they need to make informed, educated choices about their healthcare.”

This falls in line with Biden’s goal of expanding access to affordable and high-quality care. Although, the President-elect spoke more about payer transparency issues on the campaign trail. Research has also shown that less than half of hospital services are truly shoppable for patients, so requiring hospitals to publish pricing information may not be as effective at lowering healthcare costs.

Biden may, therefore, seek greater transparency through surprise billing legislation.

Surprise billing was another one of the Trump administration’s priorities. But the administration did not get as far with addressing surprise billing as it did with hospital price transparency largely because of conflicting lobbying efforts undertaken by provider and payer groups.

Biden has vowed to stop surprise billing. Details on eliminating the practice though are vague, with the campaign website merely saying that the President-elect intends to “bar health care providers from charging patients out-of-network rates when the patient doesn’t have control over which provider the patient sees (for example, during a hospitalization).”

Whatever that entails is likely to impact providers negatively, the Health Research Institute projects.

Value-based care

Value-based care has garnered bipartisan support even though the ACA implemented several programs to advance the cause. That is unlikely to change even if the Supreme Court strikes down the law.

Providers should, therefore, anticipate a greater emphasis on value-based care reforms under a Biden presidency, especially after the COVID-19 pandemic highlighted the shortcomings of a fee-for-service system.

But healthcare executives can expect a shift in the implementation of value-based care models. For example, the Trump administration emphasized the role of financial risk in value-based care, altering existing models to increase risk levels and offering new risk-heavy models, including direct contracting, which is full risk.

How Biden will move forward with the new models will largely depend on who he chooses to fill key HHS and CMS roles. But his campaign has indicated that alternative payment models run by the government could shift their priorities a little.

Health equity is a top priority for the President-elect and value-based care could be one of the ways he aims to close racial disparities and gaps in healthcare. Alternative payment models could pay providers for closing care gaps according to race and ethnicity, gender, sexual orientation, and even zip code.

Reimbursement incentives under the next administration are also likely to “pivot from the volume associated with treating illness to trending the metrics associated with prevention,” Znaniec states.

“Mindsets will shift from the need for intervention due to chronic health conditions (diabetes) and preventable diseases, such as heart disease due to obesity, to measures taken to manage the consumers’ overall well-being,” the industry expert explains. “Providers should take steps now to assess the quality and efficiencies in their delivery of care to prosper long term, as the industry will continue to move towards value-based models.”

Healthcare mergers and acquisitions

Healthcare merger and acquisition activity has recently hit record highs and COVID-19 has not dampened the appetite for deals involving provider organizations. In fact, some providers are finding that a partner is necessary for maintaining financial stability during the pandemic.

Increased consolidation, however, has been linked to higher consumer prices even though providers oftentimes tout the cost savings and quality benefits associated with such deals. For this reason, government officials have been highly suspicious of healthcare merger and acquisition proposals and have intervened in several recent high-profile cases.

Under a Biden presidency, healthcare executives can expect the same scrutiny of proposed deals, if not more scrutiny, considering Vice President-elect Kamala Harris’ history of cracking down on healthcare mergers in her home state of California.

“While the Obama administration’s strategy was targeted at larger pharmaceutical companies, Biden said his administration would use existing antitrust laws to review pharmaceutical, healthcare providers and payer mergers that have taken place during the Trump Administration,” PwC’s Health Research Institute states.

The Biden administration is likely to assess these mergers for their impact on competition, consumer prices, the healthcare workforce, and even racial inequality, the Institute adds.

“A focused policy targeting consolidation of providers, in particular, could hamper deals that are struck in the wake of the pandemic, as financially struggling providers seek safe harbor in health systems looking to expand,” they state.

The approach is likely to impact providers negatively, so it will be Biden’s responsibility to “communicate the benefits that come to both providers and patients under a fundamentally different approach,” Numerof says.

“A market-based model, for example, is built on transparency in cost and quality – a top priority for the new administration,” the consultant explains. “When coupled with payment tied to outcomes, it unleashes competition over value instead of volume. A lack of volume – particularly for elective procedures – is why so many hospitals are today suffering. Helping them understand the risk that’s in fee-for-service, and see the multiple issues that can be solved by adopting a different approach, will go a long way.”

Provider groups look to inauguration day

“We both share the same top priority: fighting the battle against COVID-19."

While Biden’s healthcare agenda is a mixed bag for providers, several leading industry groups congratulated Biden and Harris for winning the election while also setting their priorities for the next four years.

“We both share the same top priority: fighting the battle against COVID-19. As we continue on the front lines in this fight, we will work as partners to protect our patients and communities, as well as support our brave health care workers,” Rick Pollack, president and CEO of the American Hospital Association, said in a statement on Nov. 7.

“Our other priorities remain the same: advancing the transformation of health care, ensuring access to coverage, enhancing the quality of care and making health care more affordable,” Pollack added. “Hospitals and health systems look forward to addressing the health care needs of our nation with the new Administration and Congress to help advance health in America.”

Addressing the COVID-19 pandemic was also naturally at the top of mind for other industry groups, but the groups also emphasized the importance of making healthcare more affordable.

“In the years ahead, we look forward to continuing to work with our nation’s leaders to strengthen the health of our nation through greater access to high-quality, affordable health coverage, increased support for medical research and public health, and efforts to end systemic racism, achieve health equity, and ensure a healthier future for all,” said David J. Skorton, MD, president and CEO of the Association of American Colleges (AAMC).

Others, like the National Association of ACOs (NAACOS), called for a greater focus on value-based care to make healthcare more affordable.

“For starters, a Biden-Harris administration should look to promote growth in ACO programs, which have proven to lower the rate of Medicare spending growth, by opening the Medicare Shared Savings Program to new ACOs interested in starting in 2021,” stated Clif Gaus, ScD, NAACOS president and CEO.

Whether the Biden administration will be able to address provider priorities over the course of the next four years will depend on a number of factors, including the Supreme Court’s decision on the legality of the ACA and how willing Congress is to work with the administration on more sweeping changes for healthcare.

Regardless of these factors, though, the next four years will be different compared to the previous administration and those differences will greatly impact healthcare executives and how they run their organizations.